BLUE GREEN ENERGY

FUELING THE FUTURE

BLUE GREEN ENERGY

FUELING THE FUTURE

Invest in the Hydrogen-Powered Future with Blue Green Energy, Inc.

Pioneering Green Hydrogen Infrastructure Across the Southwestern U.S.

Invest in the Hydrogen-Powered Future with Blue Green Energy, Inc.

Pioneering Green Hydrogen Infrastructure Across the Southwestern U.S.

About Us

About Blue Green Energy

We’re not just imagining a clean future — we’re building it. At Blue Green Energy, we’re laying the groundwork for a nationwide hydrogen economy, starting with full-service hydrogen fueling and production hubs across the Southwestern U.S.

Our flagship project is a net-zero hydrogen production facility powered by a 30 MW solar farm, with the capacity to produce 8,000 kg of green hydrogen per day. Our fueling stations will serve both hydrogen and EV vehicles, providing a clean, convenient, and scalable alternative to fossil fuels.

About Us

About Blue Green Energy

We’re not just imagining a clean future — we’re building it. At Blue Green Energy, we’re laying the groundwork for a nationwide hydrogen economy, starting with full-service hydrogen fueling and production hubs across the Southwestern U.S.

Our flagship project is a net-zero hydrogen production facility powered by a 30 MW solar farm, with the capacity to produce 8,000 kg of green hydrogen per day. Our fueling stations will serve both hydrogen and EV vehicles, providing a clean, convenient, and scalable alternative to fossil fuels.

Blue Green Energy, Inc. is dedicated to advancing the hydrogen economy by producing and distributing green hydrogen fuel. Our mission is to reduce carbon emissions from transportation by building a nationwide network of hydrogen travel centers to facilitate interstate travel and long-haul trucking. Our planned facility, located on a major interstate, will produce green hydrogen onsite and retail it onsite. It will include a restaurant, coffee shop, and a convenience store. Our facility will serve as a distribution hub for hydrogen retailers throughout the region.

To support our initiatives, Blue Green Energy is offering shares through crowdfunding, aiming to raise $5 million. This funding strategy allows both accredited and non-accredited investors to participate in the company's growth, reflecting their commitment to democratizing investment opportunities in clean energy.

The capital raised will be allocated towards acquiring property, plant, and equipment essential for constructing hydrogen production facilities. These facilities are designed to be net-zero, utilizing renewable energy sources like solar power to produce up to 8 tons of green hydrogen daily. The hydrogen produced will support the broader transition to sustainable transportation.

By focusing on green hydrogen infrastructure, Blue Green Energy aims to play a pivotal role in the global shift towards zero-emission transportation, offering sustainable fueling solutions for both hydrogen-powered cars and trucks.

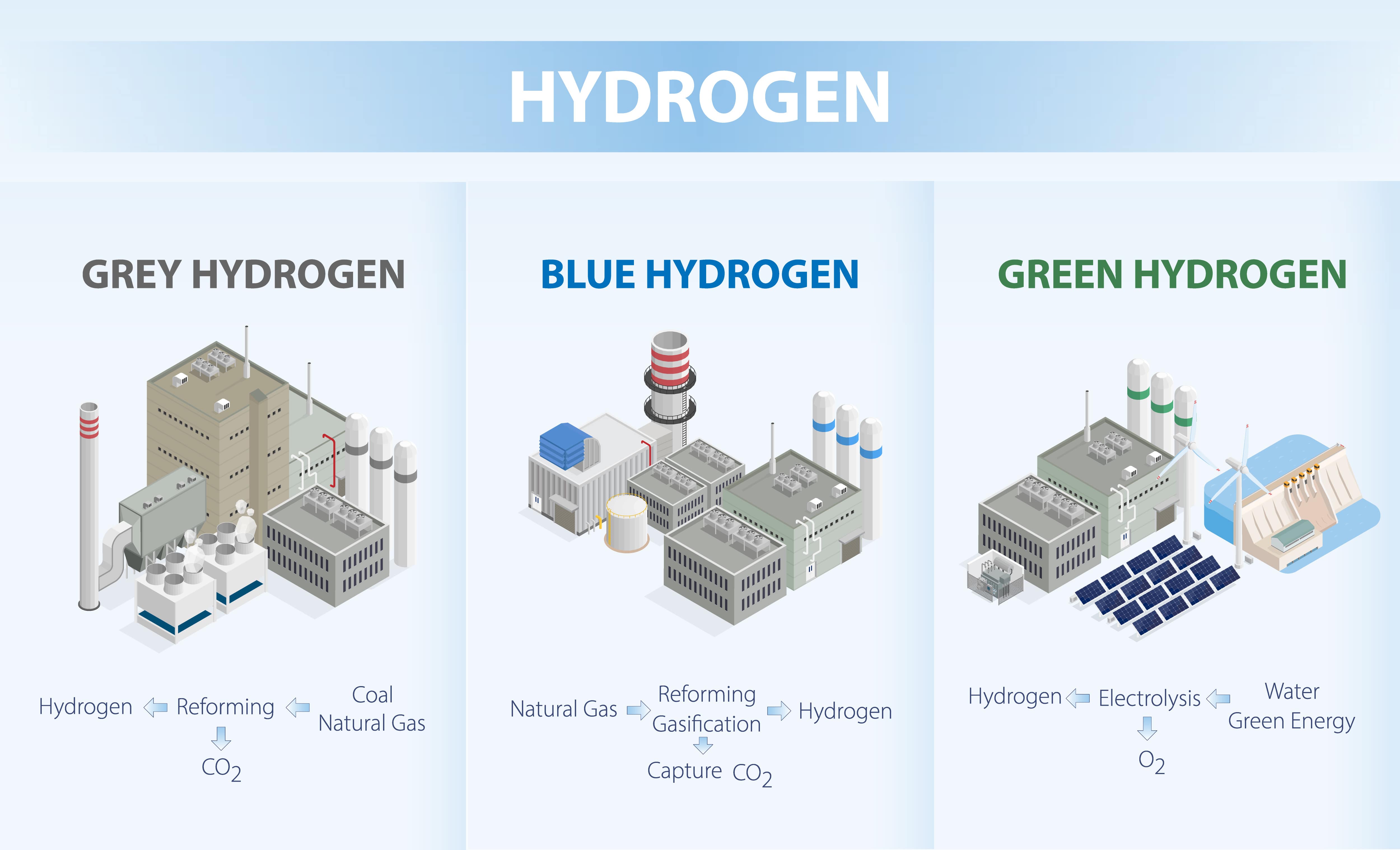

Why Hydrogen?

Hydrogen is the most abundant element in the universe and, when used as a fuel, produces zero carbon emissions. Unlike battery electric vehicles (BEVs), hydrogen fuel cell vehicles (FCEVs) can be refueled quickly and have longer ranges, making them ideal for heavy-duty transportation.

Zero Emissions: Hydrogen fuel cells emit only water vapor.

Long Range: Ideal for heavy-duty trucking, freight, and long-distance travel.

Fast Refueling: Full tanks in under 5 minutes — no waiting around to recharge.

Backed by Policy: Supported by California’s ZEV mandate and federal clean fuel tax credits.

Why Hydrogen?

Hydrogen is the most abundant element in the universe and, when used as a fuel, produces zero carbon emissions. Unlike battery electric vehicles (BEVs), hydrogen fuel cell vehicles (FCEVs) can be refueled quickly and have longer ranges, making them ideal for heavy-duty transportation.

Zero Emissions: Hydrogen fuel cells emit only water vapor.

Long Range: Ideal for heavy-duty trucking, freight, and long-distance travel.

Fast Refueling: Full tanks in under 5 minutes — no waiting around to recharge.

Backed by Policy: Supported by California’s ZEV mandate and federal clean fuel tax credits.

Highlights

Highlights

Top 3 Reasons to Invest in BGE

1. High-Growth Market with Strong Demand

The global shift toward renewable energy is accelerating, driven by government policies, corporate sustainability goals, and consumer demand for clean energy solutions. Blue Green Energy is strategically positioned in this high-growth sector, offering investors the opportunity to be part of a rapidly expanding market.

2. Innovative & Sustainable Energy Solutions

Blue Green Energy leverages cutting-edge technology to provide cost-effective, reliable, and sustainable energy solutions. The company focuses on reducing carbon footprints, integrating smart energy management, and enhancing efficiency—giving it a competitive edge in the renewable energy landscape.

3. Positive Environmental & Social Impact

Investing in Blue Green Energy means supporting a company that is actively combating climate change and promoting energy equity. By providing clean, affordable energy solutions, the company helps communities transition to a greener future while fostering sustainability and social responsibility.

1. High-Growth Market with Strong Demand

The global shift toward renewable energy is accelerating, driven by government policies, corporate sustainability goals, and consumer demand for clean energy solutions. Blue Green Energy is strategically positioned in this high-growth sector, offering investors the opportunity to be part of a rapidly expanding market.

2. Innovative & Sustainable Energy Solutions

Blue Green Energy leverages cutting-edge green technology to provide cost-effective, reliable, and sustainable energy solutions. The company focuses on reducing carbon footprints, integrating smart energy management, and enhancing efficiency—giving it a competitive edge in the renewable energy landscape.

3. Positive Environmental & Social Impact

Investing in Blue Green Energy means supporting a company that is actively combating climate change and promoting energy equity. By providing clean, affordable energy solutions, the company helps communities transition to a greener future while fostering sustainability and social responsibility.

Invest In

Blue Green Energy, Inc.

"Fueling the Future"

Help us meet the increasing demand for green hydrogen energy while laying the groundwork for a sustainable and future-oriented energy sector.

Invest In

Blue Green Energy, Inc.

"Fueling the Future"

Help us meet the increasing demand for green hydrogen energy while laying the groundwork for a sustainable and future-oriented energy sector.

Minimum Investment

$625.00 / 250 shares

Share Price

$2.50

Maximum Raise

$5,000,000.00

Raise to-date

$--.--

Target Minimum

$50,00.00

Minimum Investment

$625.00 / 250 shares

Share Price

$2.50

Maximum Raise

$5,000,000.00

Raise to-date

$--.--

Target Minimum

$50,00.00

Opportunity

Opportunity

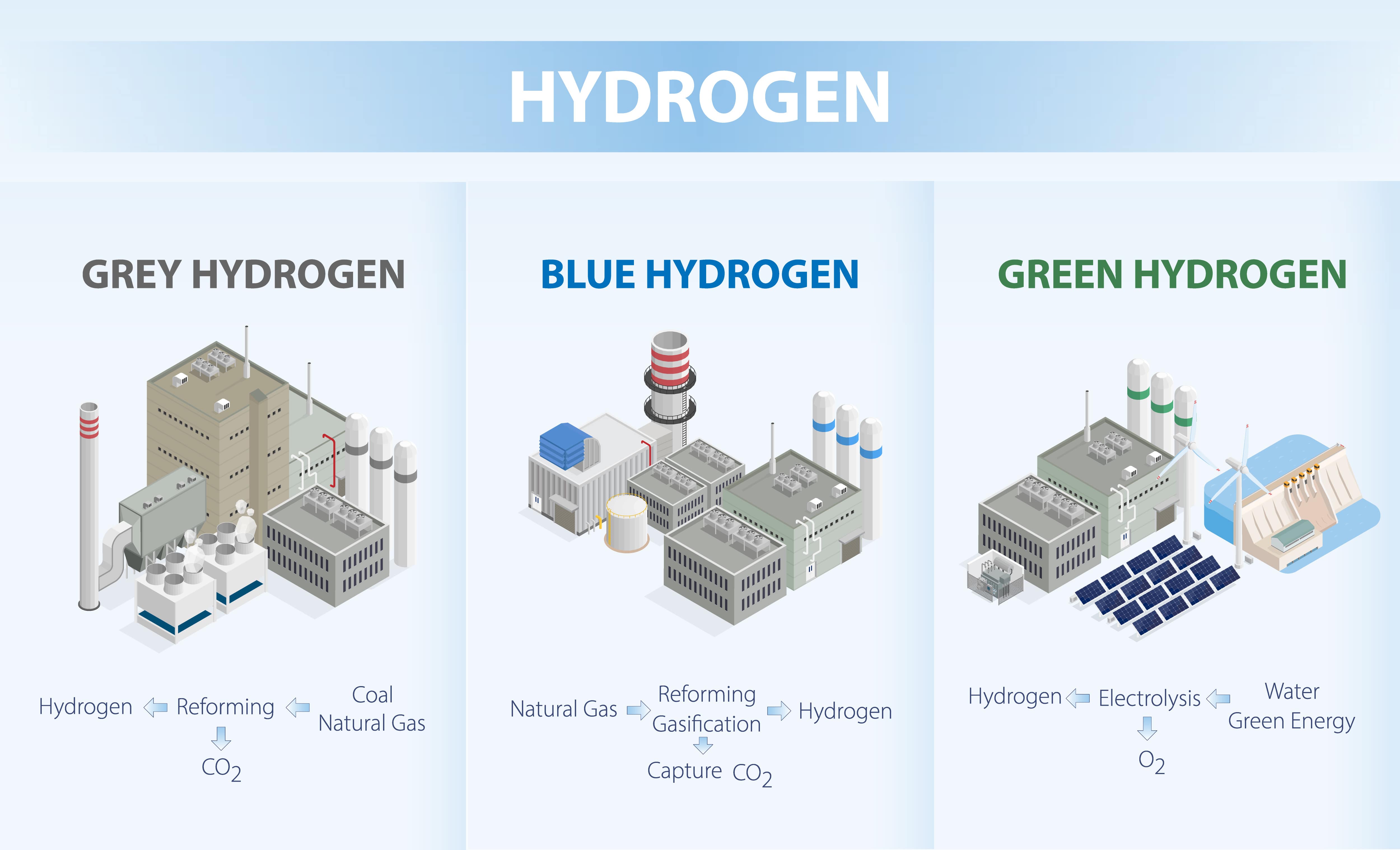

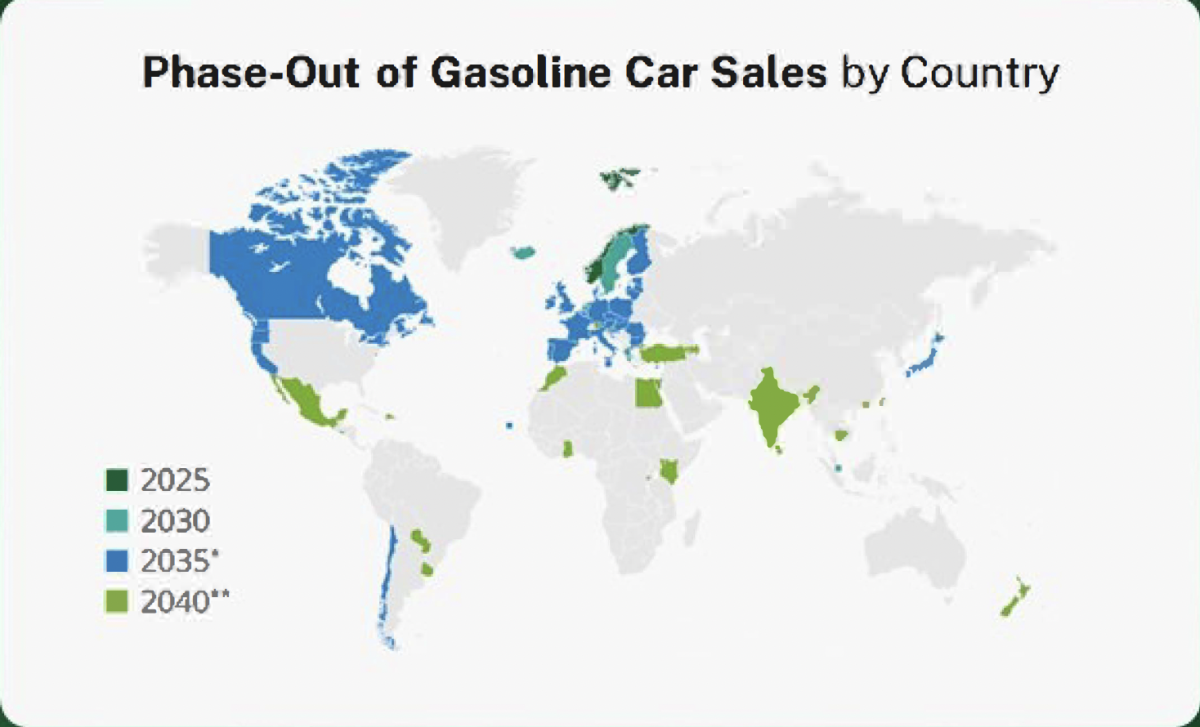

THE GLOBAL PUSH TO NET ZERO IS UNDERWAY.

145 Countries have pledges to get to net zero

50 of those Countries and 13 U.S. states have banned new gasoline powered car sales by 2035.

Climate Commitments: Countries around the world are setting aggressive net-zero targets. Hydrogen, especially green hydrogen (produced using renewable electricity), plays a critical role in decarbonizing industries like steel, cement, chemicals, aviation, and shipping.

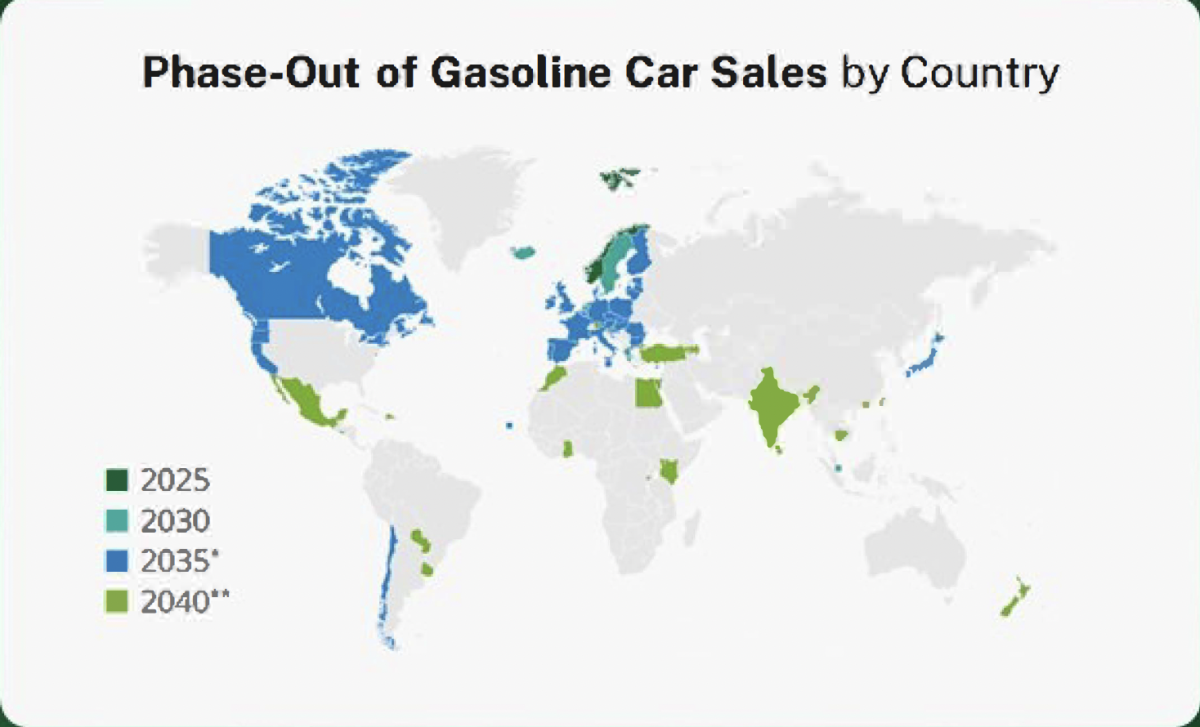

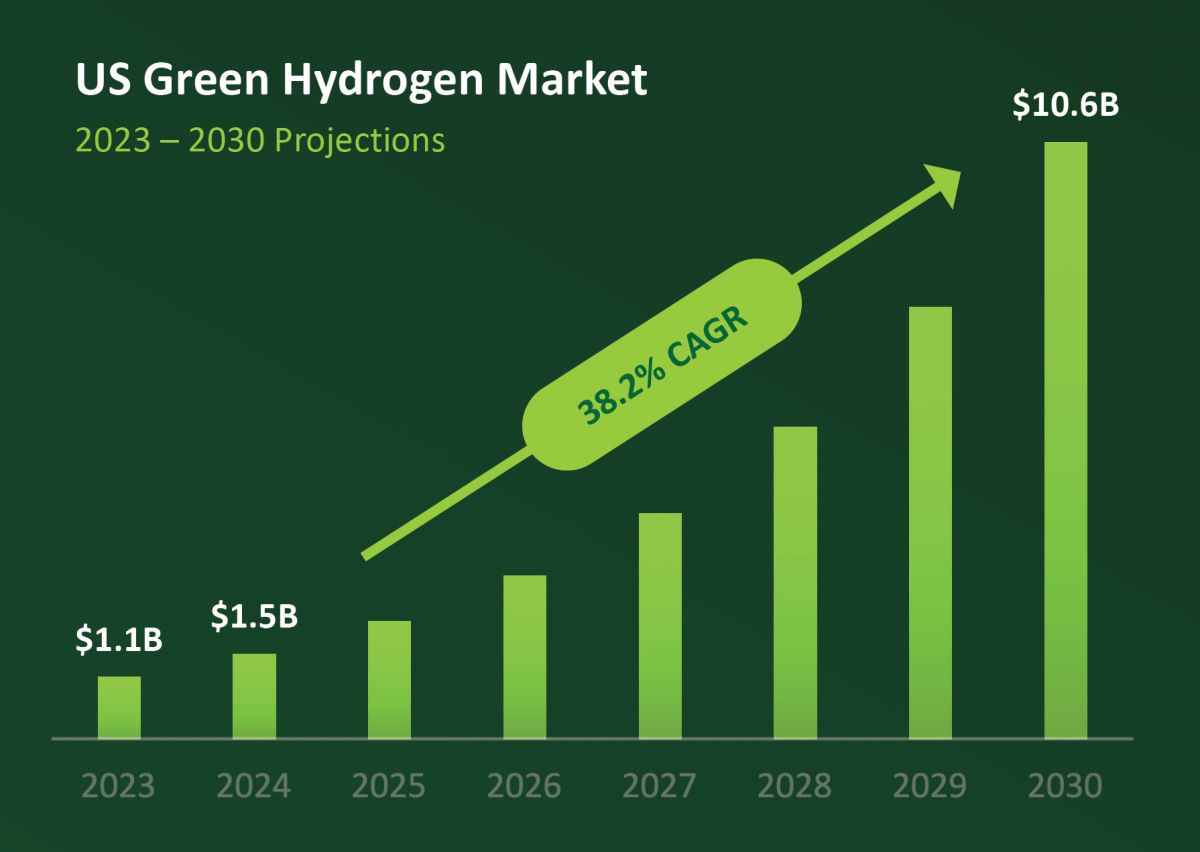

THE FUTURE OF H2 IS NOW: Growing Demand, Technological Breakthroughs, and Regulatory Support are expected to send demand soaring

Goldman Sachs: "Hydrogen Generation Could Grow Into $1 Trillion Per Year Market"

Billions in funding is pouring into building green hydrogen infrastucture.

Growing Market and Demand

Market Size: The global hydrogen market is expected to grow exponentially, estimated to reach over $500 billion by 2050, with green hydrogen driving much of the growth.

Technological Breakthroughs

> Falling Costs: Electrolyzer costs are dropping due to scale, innovation, and increased manufacturing capacity (especially from China).

> Efficiency Gains: Ongoing R&D is making production, storage, and transport of hydrogen more efficient and cost-effective.

Strong Policy and Financial Backing

Massive Government Support:

* The U.S. Inflation Reduction Act includes tax credits for clean hydrogen production.

* The EU Hydrogen Strategy sets ambitious targets with billions earmarked for hydrogen infrastructure

* Exxon, Shell, Air Products, Toyota, Honda, Hyundai are amongst the dozens of companies committed to hydrogen

THE GLOBAL PUSH TO NET ZERO IS UNDERWAY.

145 Countries have pledges to get to net zero

50 of those Countries and 13 U.S. states have banned new gasoline powered car sales by 2035.

Climate Commitments: Countries around the world are setting aggressive net-zero targets. Hydrogen, especially green hydrogen (produced using renewable electricity), plays a critical role in decarbonizing industries like steel, cement, chemicals, aviation, and shipping.

THE FUTURE OF H2 IS NOW: Growing Demand, Technological Breakthroughs, and Regulatory Support are expected to send demand soaring

Goldman Sachs: "Hydrogen Generation Could Grow Into $1 Trillion Per Year Market"

Billions in funding is pouring into building green hydrogen infrastucture.

Growing Market and Demand

Market Size: The global hydrogen market is expected to grow exponentially, estimated to reach over $500 billion by 2050, with green hydrogen driving much of the growth.

Technological Breakthroughs

> Falling Costs: Electrolyzer costs are dropping due to scale, innovation, and increased manufacturing capacity (especially from China).

> Efficiency Gains: Ongoing R&D is making production, storage, and transport of hydrogen more efficient and cost-effective.

Strong Policy and Financial Backing

Massive Government Support:

* The U.S. Inflation Reduction Act includes tax credits for clean hydrogen production.

* The EU Hydrogen Strategy sets ambitious targets with billions earmarked for hydrogen infrastructure

* Exxon, Shell, Air Products, Toyota, Honda, Hyundai are amongst the dozens of companies committed to hydrogen

Problem

Problem

Problem

LACK OF H2 REFULEING STATIONS IS PROHIBITING THE MASS ADOPTION OF HYDROGEN VEHICLES

> THE GLOBAL TRANSITION TO NET ZERO IS UNDERWAY

> BATTERY ELECTRIC CANNOT WORK AT SCALE

> HYDROGEN IS THE KEY TO NET ZERO

> LACK OF INFRASTRUCTURE IS PROHIBITING MASS ADOPTION

BATTERY ELECTRIC CANNOT WORK AT SCALE

- Reliant on aging power grid

- Recycling of toxic materials

- Stripmining of rare earth minerals

NUCLEAR POSES TOO GREAT AN ENVIRONMENTAL RISK

- Limited fuel supply

- Environmental impact

- Radioactive waste

HYDROGEN IS THE WAY TO ACHIEVE NET ZERO

- Refueling stations are neccesary

- Transportation issues need to be solved

- Zero emmission H2 production needs to be built

LACK OF H2 REFULEING STATIONS IS PROHIBITING THE MASS ADOPTION OF HYDROGEN VEHICLES

> THE GLOBAL TRANSITION TO NET ZERO IS UNDERWAY

> BATTERY ELECTRIC CANNOT WORK AT SCALE

> HYDROGEN IS THE KEY TO NET ZERO

> LACK OF INFRASTRUCTURE IS PROHIBITING MASS ADOPTION

BATTERY ELECTRIC CANNOT WORK AT SCALE

- Reliant on aging power grid

- Recycling of toxic materials

- Stripmining of rare earth minerals

NUCLEAR POSES TOO GREAT AN ENVIRONMENTAL RISK

- Limited fuel supply

- Environmental impact

- Radioactive waste

HYDROGEN IS THE WAY TO ACHIEVE NET ZERO

- Refueling stations are neccesary

- Transportation issues need to be solved

- Zero emmission H2 production needs to be built

Solution

Solution

BLUE GREEN ENERGY IS BUILDING THE INFRASTRUCTURE NECCESARY TO SUPPORT THE TRANSITION TO NET ZERO.

Blue Green Energy aims to revolutionize the energy landscape by:

* Producing green hydrogen through electrolysis powered by renewable energy sources like solar power.

* Building a network of hydrogen fueling stations and travel centers across the Southwestern United States.

* Facilitating the transition to zero-emission transportation by providing the necessary infrastructure for FCEVs.

Our first facility will be a Net Zero, 100% Green Energy operation, setting the standard for future developments.

Project Highlights

Nationwide network

of fueling stations

Storage & distribution

of hydrogen to retailers

Hydrogen fuel sales

to vehicle owners

Get our investor deck for an

in-depth look.

BLUE GREEN ENERGY IS BUILDING THE INFRASTRUCTURE NECCESARY TO SUPPORT THE TRANSITION TO NET ZERO.

Blue Green Energy aims to revolutionize the energy landscape by:

* Producing green hydrogen through electrolysis powered by renewable energy sources like solar power.

* Building a network of hydrogen fueling stations and travel centers across the Southwestern United States.

* Facilitating the transition to zero-emission transportation by providing the necessary infrastructure for FCEVs.

Our first facility will be a Net Zero, 100% Green Energy operation, setting the standard for future developments.

Project Highlights

Nationwide network

of fueling stations

Storage & distribution

of hydrogen to retailers

Hydrogen fuel sales

to vehicle owners

Get our investor deck for an

in-depth look.

Scaling to build a national network

Launching with initial capacity of 8,000kg of hydrogen production daily, growing to 12,000kg.

PHASE I

Property

acqusition

Acquistion, permitting, zoning, and regulatory approval. Engage Contractors, architects, solor installers, ect.

PHASE II

Target: Solar Infrastructure Deployment

Subject to raising additional capital, we intend to develop a 30MW solar installation across 200 acres. This solar array, made up of six 5MW grids, is designed to support green hydrogen production operations.

PHASE III

Target: Facility and Travel Center Development

Build 35,000 sq ft fueling station & travel center with hydrogen pumps, battery EV chargers, and ample food and rest amenities.

PHASE IV

Target: Broader Expansion via Public Offering

Following the successful operation of our initial facility, we may pursue a public offering. If completed, and subject to capital availability, we plan to explore expansion opportunities by developing up to four additional facilities aligned with key shipping routes out of Long Beach..

Scaling to build a national network

Launching with initial capacity of 8,000kg of hydrogen production daily, growing to 12,000kg.

PHASE I

Property

acqusition

Acquistion, permitting, zoning, and regulatory approval. Engage Contractors, architects, solor installers, ect.

PHASE II

Target: Solar Infrastructure Deployment

Subject to raising additional capital, we intend to develop a 30MW solar installation across 200 acres. This solar array, made up of six 5MW grids, is designed to support green hydrogen production operations.

PHASE III

Target: Facility and Travel Center Development

Build 35,000 sq ft fueling station & travel center with hydrogen pumps, battery EV chargers, and ample food and rest amenities.

PHASE IV

Target: Broader Expansion via Public Offering

Following the successful operation of our initial facility, we may pursue a public offering. If completed, and subject to capital availability, we plan to explore expansion opportunities by developing up to four additional facilities aligned with key shipping routes out of Long Beach.

Road map

Business Model

Blue Green Energy, Inc. (BGE) has developed a diversified revenue model centered on green hydrogen production and infrastructure, strategically designed to capitalize on the growing demand for clean transportation and renewable energy solutions. Here's an overview of our key revenue streams:

Hydrogen Production and Sales

BGE's primary revenue source is the production and sale of green hydrogen. Our flagship facility will utilize a 30-megawatt solar farm to produce up to 8,000 kilograms of hydrogen daily through electrolysis—a process powered entirely by renewable energy. This zero-emission hydrogen is intended for fuel cell electric cars and trucks (FCEVs). Current Hydrogen prices in California is about $16kg and up.

Hydrogen Refueling and EV Charging Stations

BGE is constructing a national network of hydrogen refueling stations and rapid DC fast-charging stations for electric vehicles. These stations are designed to serve both light-duty and heavy-duty vehicles, addressing the current scarcity of hydrogen fueling infrastructure, particularly for long-haul trucking.

Travel Center Amenities and Franchising

To enhance the customer experience and create additional revenue streams, BGE's fueling stations are being developed as full-service travel centers. These centers will feature a restaurant, coffee shop, and a convenience store. Revenue from these amenities will supplement fuel sales. In the future Blue Green Energy will offering franchise opportunities further expanding the brand and increasing revenue.

Road map

Business Model

Blue Green Energy, Inc. (BGE) has developed a diversified revenue model centered on green hydrogen production and infrastructure, strategically designed to capitalize on the growing demand for clean transportation and renewable energy solutions. Here's an overview of our key revenue streams:

Hydrogen Production and Sales

BGE's primary revenue source is the production and sale of green hydrogen. Our flagship facility will utilize a 30-megawatt solar farm to produce up to 8,000 kilograms of hydrogen daily through electrolysis—a process powered entirely by renewable energy. This zero-emission hydrogen is intended for fuel cell electric cars and trucks (FCEVs). Current Hydrogen prices in California is about $16kg and up.

Hydrogen Refueling and EV Charging Stations

BGE is constructing a national network of hydrogen refueling stations and rapid DC fast-charging stations for electric vehicles. These stations are designed to serve both light-duty and heavy-duty vehicles, addressing the current scarcity of hydrogen fueling infrastructure, particularly for long-haul trucking.

Travel Center Amenities and Franchising

To enhance the customer experience and create additional revenue streams, BGE's fueling stations are being developed as full-service travel centers. These centers will feature a restaurant, coffee shop, and a convenience store. Revenue from these amenities will supplement fuel sales. In the future Blue Green Energy will offering franchise opportunities further expanding the brand and increasing revenue.

Why Invest

Why Invest

Blue Green Energy, Inc. is uniquely positioned at the forefront of the green hydrogen revolution, a sector poised for massive growth as the world transitions to zero-emission energy.

Invest with Purpose: Support renewable energy projects that make a real difference in the fight against climate change.

Access High-Growth Sectors: Get involved in clean energy and green technology; industries with strong momentum and long-term potential

Diversify Easily: Add eco-conscious investments to your portfolio through a user-friendly and transparent crowdfunding platform.

Start Small, Think Big: Participate with modest amounts and still be part of exciting, scalable energy ventures.

Be Part of a Community: Join a growing network of everyday investors backing sustainable innovation.

Portfolio Diversification: Enhance your investment strategy with exposure to green energy assets through a regulated and transparent crowdfunding platform

Blue Green Energy, Inc. is uniquely positioned at the forefront of the green hydrogen revolution, a sector poised for massive growth as the world transitions to zero-emission energy.

Invest with Purpose: Support renewable energy projects that make a real difference in the fight against climate change.

Access High-Growth Sectors: Get involved in clean energy and green technology; industries with strong momentum and long-term potential

Diversify Easily: Add eco-conscious investments to your portfolio through a user-friendly and transparent crowdfunding platform.

Start Small, Think Big: Participate with modest amounts and still be part of exciting, scalable energy ventures.

Be Part of a Community: Join a growing network of everyday investors backing sustainable innovation.

Portfolio Diversification: Enhance your investment strategy with exposure to green energy assets through a regulated and transparent crowdfunding platform

FAQs

Crowdfunding allows investors to support startups and early-growth companies that they are passionate about. This is different from helping a company raise money on Kickstarter. With Regulation CF Offerings, you aren’t buying products or merch. You are buying a piece of a company and helping it grow.

The majority of offerings are common stock, though some companies may raise capital through convertible note, debt, and revenue share.

Investors other than accredited investors are limited in the amounts they are allowed to invest in all Regulation Crowdfunding offerings (on this site and elsewhere) over the course of a 12-month period: If either of an investor’s annual income or net worth is less than $124,000, then the investor’s investment limit $2,500, or 5 percent of the greater of the investor’s annual income or net worth, whichever is greater. If both an investor’s annual income and net worth are $124,000 or higher, then the investor’s limit is 10 percent of the greater of their annual income or net worth, or $124,000 whichever is greater. Accredited investors are not limited in the amount they can invest.

Calculating net worth involves adding up all your assets and subtracting all your liabilities. The resulting sum is your net worth.

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Individuals over 18 years of age can invest. Currently however, Canadian citizens are not able to invest in Regulation CF offerings.

Ref CF Offerings are high risk opportunities and may not retain their value. Investing in startups and small businesses is inherently risky and standard company risk factors such as execution and strategy risk are often magnified at the early stages of a company. In the event that a company goes out of business, your ownership interest could lose all value. Furthermore, private investments in startup companies are illiquid instruments that typically take up to five and seven years (if ever) before an exit via acquisition, IPO, etc.

Companies conducting a Reg CF are privately held companies, and their shares are not traded on a public stock exchange. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically receive a return on your investment under the following two scenarios: The company gets acquired by another company. The company goes public (makes an initial public offering on the NASDAQ, NYSE, or another exchange). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on the exchange. It can take 5-7 years (or longer) to see a distribution or trading, as it takes years to build companies. In many cases, there will not be any return as a result of business failure.

Dalmore Group, LLC does not make investment recommendations, and no communication, through this website or in any other medium should be construed as a recommendation for any security offered on or off this investment platform.

Investments in private placements and start-up investments in particular are speculative and involve a high degree of risk, and those investors who cannot afford to lose their entire investment should not invest in start-ups.

Companies seeking startup investments tend to be in earlier stages of development, and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations.

Additionally, investors on Regulation CF offerings will receive securities that are subject to holding period requirements. In the most sensible investment strategy for start-up investing, start-ups should only be part of your overall investment portfolio.

Further, the start-up portion of your portfolio may include a balanced portfolio of different start-ups. Investments in startups are highly illiquid and those investors who cannot hold an investment for the long term (at least 5-7 years) should not invest.

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold freely. The only exceptions to this one-year limit are when transferring shares to:

The organization of the company: Dalmore Group, LLC requires information that shows the issuer company has taken steps necessary to organize as a corporation or LLC in its state of organization, is in good standing, and that the securities being issued will be duly authorized and validly issued.

The corporate structure and ownership: Dalmore Group, LLC works with the issuer company to disclose its organizational structure, affiliated entities, and current capitalization.

The people behind the company: Dalmore Group, LLC helps the issuer company disclose who is behind the operations and strategy of the company, along with their previous related experience, and Bad Actor Reports to provide evidence that the company is not disqualified from proceeding with its offering.

Information provided to investors: Dalmore Group, LLC checks that the issuer company is providing clear disclosure of its financial situation, business origins, and operations, and legal authority to engage in its business activities.

Investor information and terms of the offering: Dalmore Group, LLC reviews for consistency each instance where the issuer company describes the offering terms, and identifies to investors how the issuer company reached its current valuation and will track and keep in touch with its security holders.

Review of transaction documents: Dalmore Group, LLC performs an independent review of transaction documents to check for red flags & conformance with stated terms.

Business due diligence: Dalmore Group, LLC conducts research and due diligence on each company before it is able to accept investments on the platform. Dalmore Group, LLC will typically conduct hours of due diligence per opportunity, which requires the satisfactory completion of a detailed set of individual questions and data requests.

Particular focus is paid to the following issues throughout the due diligence process:

The findings of the foregoing review are presented to Dalmore Group, LLC, which may approve, reject, or require additional information for the offering. Upon approval and following the onboarding process, an offering can begin accepting investments online.

General considerations: Notwithstanding the foregoing, these investments are illiquid, risky, and speculative and you may lose your entire investment. The foregoing summarizes our standard process. However, each diligence review is tailored to the nature of the company, so the aforementioned process is not the same for every issuer.

Completing the vetting process does NOT guarantee that the company has no outstanding issues or that problems will not arise in the future. While the foregoing process is designed to identify material issues, there is no guarantee that there will not be errors, omissions, or oversights in the due diligence process or in the work of third-party vendors utilized by Dalmore Group, LLC.

Each investor must conduct their own independent review of documentation and perform their own independent due diligence and should ask for any further information required to make an investment decision.

If a company does not reach its minimum funding goal, all funds will be returned to the investors after the closing of their offering.

All available financial information can be found on the offering pages for the company’s Regulation Crowdfunding offering.

You may cancel your investment at any time, for any reason until 48 hours prior to a closing occurring. If you have already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: ir@bgenergyinc.com

If you have questions that have not been answered in the FAQ, please email our Investor Support Team at: ir@bgenergyinc.com

Please download additional Education Materials here.

Crowdfunding allows investors to support startups and early-growth companies that they are passionate about. This is different from helping a company raise money on Kickstarter. With Regulation CF Offerings, you aren’t buying products or merch. You are buying a piece of a company and helping it grow.

The majority of offerings are common stock, though some companies may raise capital through convertible note, debt, and revenue share.

Investors other than accredited investors are limited in the amounts they are allowed to invest in all Regulation Crowdfunding offerings (on this site and elsewhere) over the course of a 12-month period: If either of an investor’s annual income or net worth is less than $124,000, then the investor’s investment limit $2,500, or 5 percent of the greater of the investor’s annual income or net worth, whichever is greater. If both an investor’s annual income and net worth are $124,000 or higher, then the investor’s limit is 10 percent of the greater of their annual income or net worth, or $124,000 whichever is greater. Accredited investors are not limited in the amount they can invest.

Calculating net worth involves adding up all your assets and subtracting all your liabilities. The resulting sum is your net worth.

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Individuals over 18 years of age can invest. Currently however, Canadian citizens are not able to invest in Regulation CF offerings.

Ref CF Offerings are high risk opportunities and may not retain their value. Investing in startups and small businesses is inherently risky and standard company risk factors such as execution and strategy risk are often magnified at the early stages of a company. In the event that a company goes out of business, your ownership interest could lose all value. Furthermore, private investments in startup companies are illiquid instruments that typically take up to five and seven years (if ever) before an exit via acquisition, IPO, etc.

Companies conducting a Reg CF are privately held companies, and their shares are not traded on a public stock exchange. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically receive a return on your investment under the following two scenarios: The company gets acquired by another company. The company goes public (makes an initial public offering on the NASDAQ, NYSE, or another exchange). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on the exchange. It can take 5-7 years (or longer) to see a distribution or trading, as it takes years to build companies. In many cases, there will not be any return as a result of business failure.

Dalmore Group, LLC does not make investment recommendations, and no communication, through this website or in any other medium should be construed as a recommendation for any security offered on or off this investment platform.

Investments in private placements and start-up investments in particular are speculative and involve a high degree of risk, and those investors who cannot afford to lose their entire investment should not invest in start-ups.

Companies seeking startup investments tend to be in earlier stages of development, and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations.

Additionally, investors on Regulation CF offerings will receive securities that are subject to holding period requirements. In the most sensible investment strategy for start-up investing, start-ups should only be part of your overall investment portfolio.

Further, the start-up portion of your portfolio may include a balanced portfolio of different start-ups. Investments in startups are highly illiquid and those investors who cannot hold an investment for the long term (at least 5-7 years) should not invest.

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold freely. The only exceptions to this one-year limit are when transferring shares to:

The organization of the company: Dalmore Group, LLC requires information that shows the issuer company has taken steps necessary to organize as a corporation or LLC in its state of organization, is in good standing, and that the securities being issued will be duly authorized and validly issued.

The corporate structure and ownership: Dalmore Group, LLC works with the issuer company to disclose its organizational structure, affiliated entities, and current capitalization.

The people behind the company: Dalmore Group, LLC helps the issuer company disclose who is behind the operations and strategy of the company, along with their previous related experience, and Bad Actor Reports to provide evidence that the company is not disqualified from proceeding with its offering.

Information provided to investors: Dalmore Group, LLC checks that the issuer company is providing clear disclosure of its financial situation, business origins, and operations, and legal authority to engage in its business activities.

Investor information and terms of the offering: Dalmore Group, LLC reviews for consistency each instance where the issuer company describes the offering terms, and identifies to investors how the issuer company reached its current valuation and will track and keep in touch with its security holders.

Review of transaction documents: Dalmore Group, LLC performs an independent review of transaction documents to check for red flags & conformance with stated terms.

Business due diligence: Dalmore Group, LLC conducts research and due diligence on each company before it is able to accept investments on the platform. Dalmore Group, LLC will typically conduct hours of due diligence per opportunity, which requires the satisfactory completion of a detailed set of individual questions and data requests.

Particular focus is paid to the following issues throughout the due diligence process:

The findings of the foregoing review are presented to Dalmore Group, LLC, which may approve, reject, or require additional information for the offering. Upon approval and following the onboarding process, an offering can begin accepting investments online.

General considerations: Notwithstanding the foregoing, these investments are illiquid, risky, and speculative and you may lose your entire investment. The foregoing summarizes our standard process. However, each diligence review is tailored to the nature of the company, so the aforementioned process is not the same for every issuer.

Completing the vetting process does NOT guarantee that the company has no outstanding issues or that problems will not arise in the future. While the foregoing process is designed to identify material issues, there is no guarantee that there will not be errors, omissions, or oversights in the due diligence process or in the work of third-party vendors utilized by Dalmore Group, LLC.

Each investor must conduct their own independent review of documentation and perform their own independent due diligence and should ask for any further information required to make an investment decision.

If a company does not reach its minimum funding goal, all funds will be returned to the investors after the closing of their offering.

All available financial information can be found on the offering pages for the company’s Regulation Crowdfunding offering.

You may cancel your investment at any time, for any reason until 48 hours prior to a closing occurring. If you have already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: ir@bgenergyinc.com

If you have questions that have not been answered in the FAQ, please email our Investor Support Team at: ir@bgenergyinc.com

Please download additional Education Materials here.

This site is operated by Dalmore Group, LLC (“Dalmore Group”), which is a registered broker-dealer, and member of FINRA | SIPC, located at 530 7th Avenue, Suite 902, New York, NY 10018, please check our background on FINRA’s BrokerCheck. All securities-related activity is conducted by Dalmore Group, LLC (“Dalmore Group”). Dalmore Group does not make investment recommendations and no communication, through this website or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investments through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Additionally, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns. In the most sensible investment strategy for start-up investing, start-ups should only be part of your overall investment portfolio. Further, the start-up portion of your portfolio may include a balanced portfolio of different start-ups. Investments in startups are highly illiquid and those investors who cannot hold an investment for the long term (at least 5-7 years) should not invest. Dalmore Group does not provide custody services in connection any investments made through the platform.

This site is operated by Dalmore Group, LLC (“Dalmore Group”), which is a registered broker-dealer, and member of FINRA | SIPC, located at 530 7th Avenue, Suite 902, New York, NY 10018, please check our background on FINRA’s BrokerCheck. All securities-related activity is conducted by Dalmore Group, LLC (“Dalmore Group”). Dalmore Group does not make investment recommendations and no communication, through this website or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investments through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Additionally, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns. In the most sensible investment strategy for start-up investing, start-ups should only be part of your overall investment portfolio. Further, the start-up portion of your portfolio may include a balanced portfolio of different start-ups. Investments in startups are highly illiquid and those investors who cannot hold an investment for the long term (at least 5-7 years) should not invest. Dalmore Group does not provide custody services in connection any investments made through the platform.

©2025 Blue Green Energy, Inc.